The Legend of Zelda is a rare gaming franchise in which every new entry is an event. Fans flock to these games on Day 1 to see how Nintendo has innovated on the formula, reinventing the tried-and-true action-adventure story of good vs. evil. The last two completely new entries to the series, Breath of the Wild and Tears of the Kingdom, received incredible support on live-streaming platforms: How will the latest title The Legend of Zelda: Echoes of Wisdom fare upon release?

Although all three of these titles were released on the Switch, Echoes of Wisdom follows more in the lineage of handheld Zelda games with its top-down perspective and constrained, diorama-like world (as in Triforce Heroes and A Link Between Worlds). The twist is that for the first time ever, the player actually plays as Princess Zelda herself. This hook, plus the love for The Legend of Zelda IP, set the stage for viewer interest online.

In this article, we’re looking at the live-streaming performance of Echoes of Wisdom upon release, and the state of Switch games on live-streaming platforms.

Zelda: Echoes of Wisdom’s Open-Ended Gameplay Finds an Audience

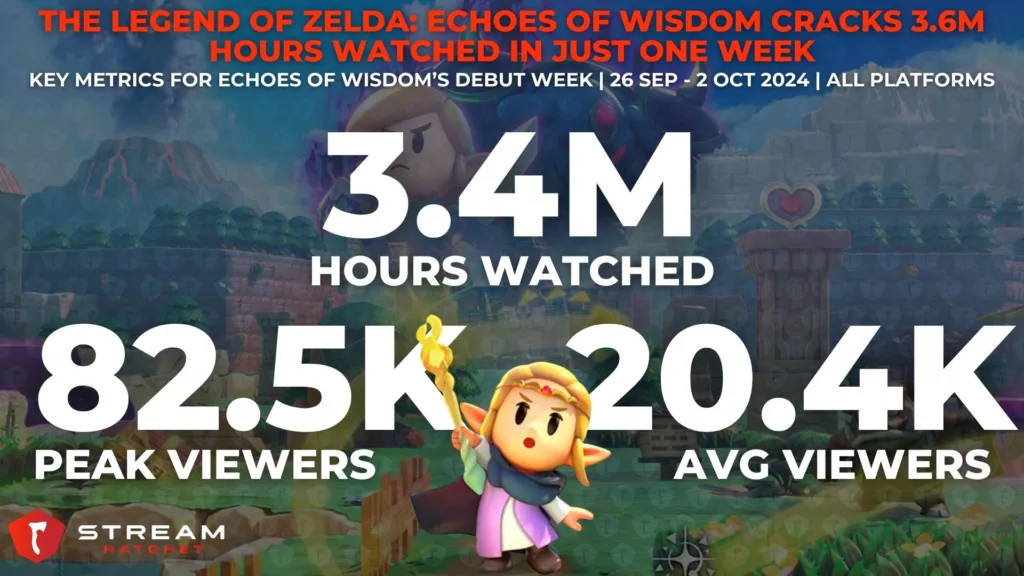

Expectations were high for Echoes of Wisdom off the back of immense hype when the game was revealed during June’s Nintendo Direct. Echoes of Wisdom met these lofty expectations with a massive 3.4M hours in its debut week and over 100K hours of airtime. To put this in perspective, the 2019 remake of Link’s Awakening – the last 2.5D Zelda game to be released – generated 2M hours watched with just over 50K hours of airtime in its debut week. This increased performance was to be expected, given that Echoes of Wisdom is an entirely new title and outsold Link’s Awakening by roughly 60K units (in retail).

But it’s not just “The Legend of Zelda game” status that boosted viewership for Echoes of Wisdom. Nintendo always innovates and, in this case, Echoes of Wisdom features a new protagonist with a completely different skill set to Link. By capturing “Echoes” to recreate objects and monsters at will, both combat and puzzle-solving are entirely different from any other the Legend of Zelda game. The Echoes system makes problem solving varied from player to player, encouraging friends to excitedly share their own solution or, indeed, to watch live streams and see how creators online beat the game. This open-ended puzzle solving was also key to Tears of the Kingdom’s live-streaming success.

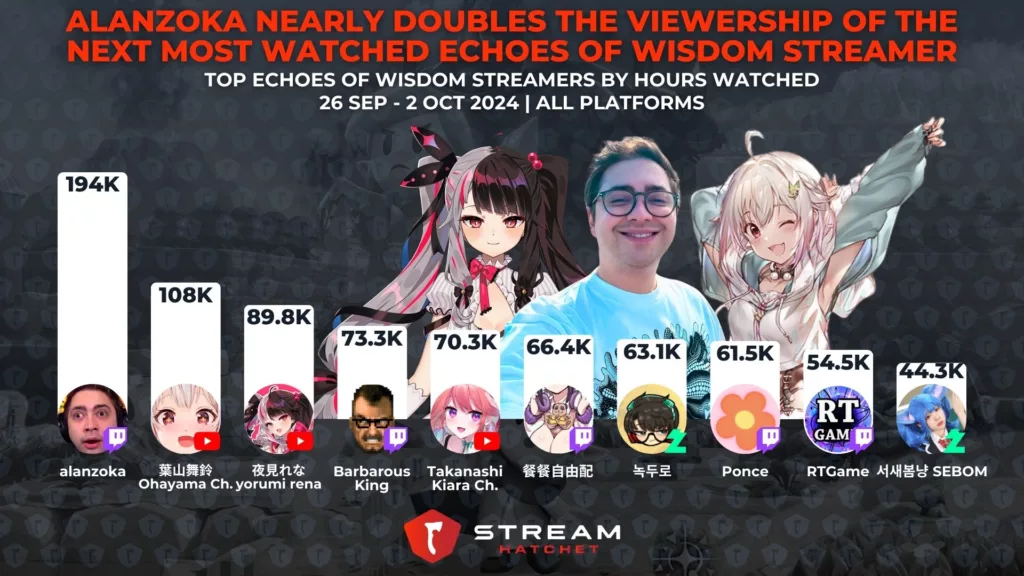

Looking now at the top streamers covering the game reveals two major trends. Firstly, alanzoka invited his Portuguese-speaking fanbase onto the Echoes of Wisdom hype train with 194K hours watched in the game’s debut week. Along with English-speaking streamer BarbarousKing (73K) and French-speaking streamer Ponce (61.5K), these three streamers brought in the majority of Echoes of Wisdom’s Western viewership.

Japanese streamers split the rest of the viewership amongst themselves. VTubers Hayama Marin and Yorumi Rena brought in the highest viewership for Echoes of Wisdom with 107.5K and 90K, respectively. Both VTubers are associated with VTuber group NIJISANJI, whereas popular Hololive VTubers didn’t seem to cover the game in its debut week. South Korean streamers like Nokduro (녹두로) also provided substantial coverage for Echoes of Wisdom on Chzzk, with Nokduro himself bringing in 63K hours watched.

The Two Biggest Switch Games on Live Streaming Aren’t From Nintendo

Nintendo excels at game development, iterating upon its backlog of IP to consistently one-up itself in terms of creativity and ways for players to interact. However, one area which Nintendo has historically struggled to jump into is online gaming and community-building (an issue dating back to the Gamecube competing with Xbox and PS2). Given this reputation, it’s worth seeing how paid Switch games actually perform on live-streaming platforms. Note that the below analysis only centers on paid titles, not F2P titles.

Looking at the 50 best-selling Switch games of all-time shows that this situation hasn’t massively changed. Over the last 12 months, the two paid Switch games with the highest viewership are Minecraft and Among Us with 707M (!) and 47M hours watched, respectively. Neither of these titles are Switch-exclusive, which means only a fraction of this viewership will be associated with Nintendo itself by viewers. There’s a similar issue with puzzle title Suika Game which is mostly played on mobile with 40M hours watched. The Switch does generate significantly more live-streaming viewership from F2P titles like Rocket League, Fortnite, and Apex Legends, but again these titles are not associated with Nintendo.

Nintendo’s two best attempts at crafting online-friendly titles are Super Smash Bros. Ultimate and Splatoon 3 with 41.5M and 35M hours watched each in the last 12 months. The Smash Bros. series is the definitive platform fighter (despite fresh competition from MultiVersus), but its live-streaming potential is limited compared to traditional 2D fighters like Street Fighter 6 and Tekken 8. Perhaps getting Smash Bros. involved in an event like EVO Japan could boost its credibility among the competitive fighting game community. Splatoon 3 similarly satisfies more casual squad-based shooter fans, but again lacks the competitive fanbase of other shooter titles necessary for mass live-streaming appeal.

Nintendo Looks to Diversify its Live-Streaming Audience

With their incredible reputation for quality, it may seem viable for Nintendo to simply eschew creating its own games for live streaming. But this could hurt them in the long run: Live streaming is how many users discover new games through referral from trusted voices in the industry. Scrappy indie developers with creative visions and brand new worlds will slowly eat away at Nintendo’s corner of the market, appealing to a new generation with less nostalgia for Nintendo’s IPs.

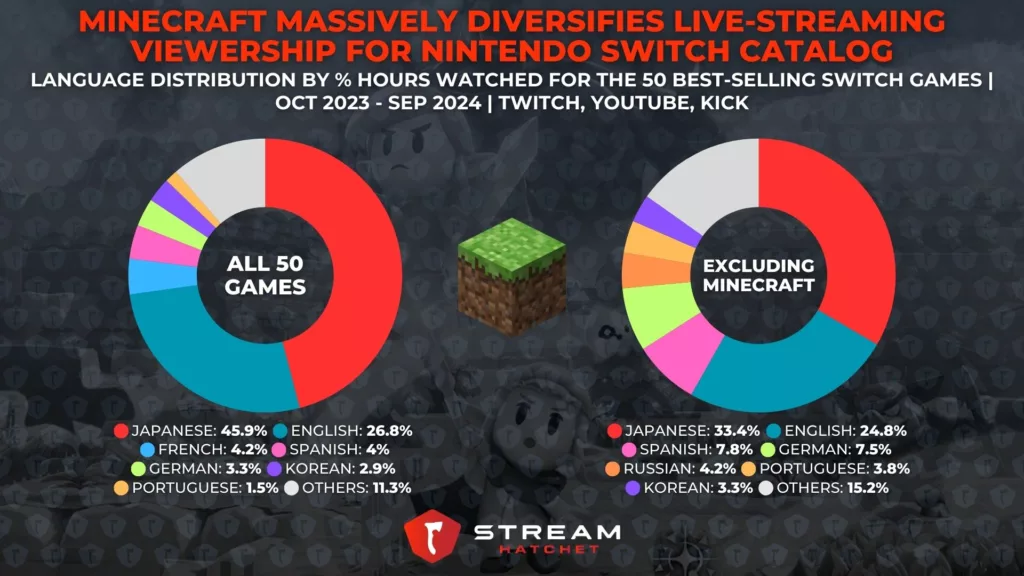

A big part of counteracting this potential shift is appealing to a global audience rather than just their local market. Again looking at the 50 best-selling Switch titles, Japanese audiences account for roughly one-third of all viewership. This doesn’t seem so bad at first, but when you remove the impact of Minecraft from these stats, the dependence on Japanese viewers balloons to 46% – nearly HALF of all live-streaming viewership. With regards to paid games then, Nintendo leans on non-exclusive titles to reach a wider audience… yet it has only a few of these with live-streaming fanbases.

This may be shifting – after all, many of the top streamers for Echoes of Wisdom were non-Japanese. But what more can Nintendo do to help make their live-streaming fanbase more global? Certain Nintendo IPs have a bigger audience in the West, such as Metroid which has tried to integrate a viable multiplayer mode into its gameplay in the past (perhaps Metroid Prime 4 will take this route?). Alternatively, embracing paid games with live-streaming presence from other publishers like Capcom could be a fantastic partnership. Monster Hunter Wilds isn’t coming out on Switch, but the game would make a welcome addition to Nintendo’s library on the Switch’s successor due to its handheld-friendly gameplay loop.

If the so-called “Switch 2” puts more emphasis on Nintendo-published games with streaming appeal, facilitates online play, and hosts more third-party publishers, the new console could push Nintendo’s branding on live-streaming platforms. For now, Echoes of Wisdom and Mario & Luigi: Brothership are the only announced Nintendo-IP titles coming to serve out the Switch’s lifespan. Stream Hatchet will watch Nintendo’s strategy as it announces new releases in Q4 2024.

To keep up to date with the latest big game launches on live-streaming platforms, follow Stream Hatchet: